Summer sale discount off 50%! Shop Now

Currency

The Future of Sustainable Materials: How Hermes Experiments with Mushroom-Based Leather

- Home

- ReplicaX Blog | Style Guides and Insider Secrets

- The Future of Sustainable Materials: How Hermes Experiments with Mushroom-Based Leather

The Future of Sustainable Materials: How Hermes Experiments with Mushroom-Based Leather

Sep 17, 2025

By

Sophia Whitmore

0 comment(s)

Introduction: A New Chapter for Luxur

For nearly two centuries, Hermès has been synonymous with the finest leather craftsmanship in the world. From its equestrian roots in 1837 to its legendary Birkin and Kelly bags, the brand has built a reputation on animal hides of unmatched quality.

But the rules of luxury are changing. In a world facing climate change, biodiversity loss, and shifting consumer values, leather is no longer just a symbol of craftsmanship—it’s a symbol of sustainability questions. Where does it come from? How much carbon did it produce? Could there be a better way?

Hermès, once seen as the guardian of tradition, is now venturing into biotechnology. In collaboration with MycoWorks, it is experimenting with mushroom-based leather, an innovative material grown from mycelium. This quiet but powerful shift signals something larger: luxury’s future will not be built only on heritage, but also on science and responsibility.

The Evolution of Sustainability in Luxury Fashion

Luxury has often been slow to embrace sustainability compared to mass-market fashion. Why? Because luxury houses define themselves through heritage, tradition, and scarcity. Any change to iconic materials can feel like a threat to their very identity.

Yet, change is unavoidable:

- Regulation: The EU’s 2030 Circular Economy Action Plan targets waste reduction and stricter standards on materials.

- Consumers: A McKinsey survey found 70% of luxury shoppers care about sustainability, and Gen Z—who will drive 40% of luxury purchases by 2030—demands transparency.

- Investors: ESG (Environmental, Social, Governance) metrics are now standard in evaluating brand health.

The challenge for Hermès isn’t just to comply, but to lead—without betraying the values that made it timeless.

Why Leather Faces Scrutiny

Leather has always been the beating heart of Hermès’ identity. But traditional leather carries steep environmental costs:

- Deforestation: 80% of Amazon deforestation is linked to cattle ranching (WWF, 2021).

- Carbon Emissions: Livestock generates 14.5% of global greenhouse gases (FAO).

- Water & Chemicals: Tanning processes consume thousands of liters of water and rely on toxic chromium.

- Waste: Leather offcuts are difficult to reuse, contributing to landfill waste.

A single leather handbag can require up to 17,000 liters of water—a staggering number in a water-scarce world.

This is why mushroom leather—and other bio-materials—are not fads. They’re necessities.

The Science of Mycelium: Nature’s Smart Material

At the core of mushroom leather lies mycelium, the root structure of fungi. Beneath forests, mycelium forms vast underground networks that recycle nutrients and sustain ecosystems. Scientists call it nature’s internet.

What makes it revolutionary for fashion:

- Rapid Growth: Mycelium can mature in weeks, compared to years for animal hides.

- Customizable: Its density, thickness, and texture can be engineered.

- Sustainable: It grows on agricultural waste, requires minimal water, and emits a fraction of the carbon of cattle.

- Biodegradable: Unlike synthetic vegan leathers, it naturally returns to the earth.

For luxury, this is the holy grail: sustainability without compromise.

Hermès and MycoWorks: When Craft Meets Biotech

In 2021, Hermès announced its collaboration with MycoWorks to develop Sylvania, a mycelium-based leather alternative.

Key features of Sylvania:

- Fine Mycelium? Process: MycoWorks’ proprietary technique structures mycelium at the cellular level, creating strength and suppleness comparable to calfskin.

- Luxury Aesthetic: Unlike plastic-based vegan leathers, Sylvania has natural grain and depth, capable of rich dyeing.

- Durability: Designed to age beautifully, echoing Hermès’ standard of heirloom quality.

Hermès’ Victoria bag, redesigned with Sylvania, became the first symbol of this collaboration. It wasn’t a radical departure, but a careful evolution: part leather, part mycelium—bridging tradition and innovation.

Beyond Mushrooms: Alternative Materials Reshaping Luxury

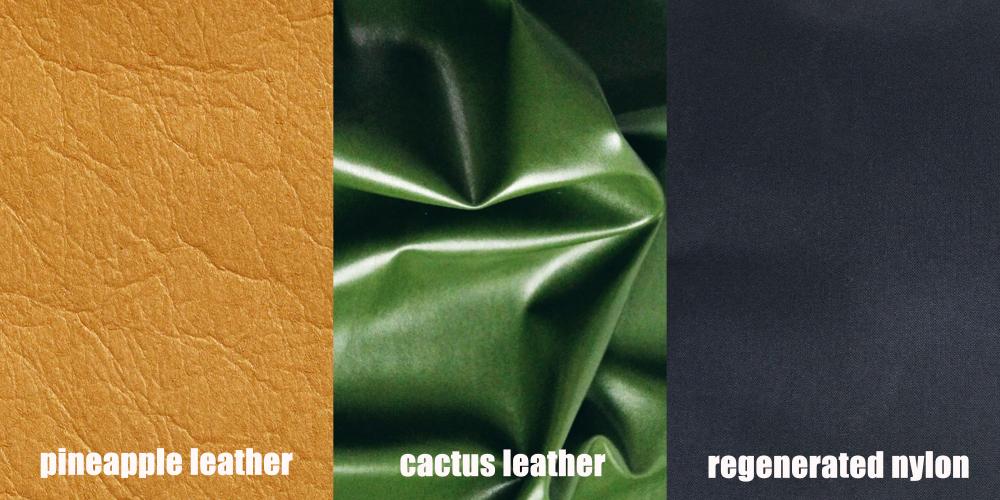

Mushroom leather is part of a global wave of material innovation:

- Pinatex (pineapple leather): Made from pineapple leaf fibers, used by Hugo Boss and H&M.

- Desserto (cactus leather): Water-efficient and durable, adopted by Karl Lagerfeld.

- Apple leather: Derived from apple waste in Italy’s juice industry, embraced by eco-accessory brands.

- Econyl (regenerated nylon): Prada and Gucci now use this in bags and footwear.

- Lab-grown collagen leather: Startups like Modern Meadow bio-engineer animal proteins without livestock.

Luxury is no longer about rejecting alternatives—it’s about leading them.

Hermès’ Sustainability Strategy: Heritage Meets Tomorrow

Hermès has long framed its products as sustainable by nature because they last generations. But in today’s world, durability alone isn’t enough. The maison now combines:

- Durability & Repair – Its repair workshops restore 200,000+ items annually, extending lifespan.

- Traceability – Investments in leather supply chain transparency to meet ethical standards.

- Innovation – Collaborations with biotech pioneers like MycoWorks.

- Circularity – Efforts to reduce waste and close loops in production.

As BCG notes:

“Extending product life by just two years reduces luxury’s environmental footprint by 24%.”

Hermès is leveraging its craftsmanship ethos to align with circular principles.

Case Studies: The Broader Luxury Movement

Hermès is not alone in this journey. Across the luxury sector, some of the most influential houses are racing to balance heritage with sustainability, each taking a unique approach.

Stella McCartney: The Pioneer

Stella McCartney has been the loudest and earliest voice in sustainable luxury. Long before sustainability became fashionable, McCartney refused to use animal leather or fur, betting her brand’s identity on innovation. She was the first luxury designer to showcase mycelium leather on the runway, partnering with Bolt Threads to launch the Frayme Mylo™ bag. While not yet mass-produced, it proved that eco-materials could meet luxury’s high standards.

Gucci and Kering: The Corporate Innovators

Gucci’s parent company, Kering, has invested heavily in sustainability through its EP&L (Environmental Profit & Loss) reporting and Demetra, its own proprietary leather alternative made from 77% plant-based raw materials. Gucci has used Demetra in sneakers, proving the scalability of luxury eco-materials. Kering also funds biotech startups, signaling its intent to shape the material future.

Prada: From Nylon to Econyl

Prada’s nylon bags are iconic. By 2022, the brand transitioned its entire nylon range to Econyl, a regenerated nylon made from fishing nets, carpets, and industrial waste. This move demonstrated that even a core signature material can evolve sustainably without losing its brand DNA.

LVMH: Investment Through Scale

Louis Vuitton’s parent group LVMH launched the LIFE 360 program, pledging to make all products eco-designed by 2030. The group is also backing startups focused on regenerative agriculture and circular fashion. Dior, Fendi, and Louis Vuitton are gradually integrating eco-materials into accessories while testing resale and rental platforms.

Burberry: Climate Positive by 2040

Burberry has announced a bold ambition: to be climate positive by 2040. This goes beyond neutrality, aiming to capture more carbon than it emits. The company is investing in regenerative farms for wool and leather and experimenting with new dye technologies.

These examples show that Hermès is part of a powerful collective shift: sustainability is no longer a marketing add-on—it’s a competitive battleground for the future of luxury.

For a deeper dive into tradition versus innovation, see our blog on The Future of Sustainable Materials

Consumer Psychology: The New Status Symbol

Luxury has always been about signaling—wealth, taste, access. But today, the meaning of status is evolving.

Generational Shifts

- Millennials (born 1981–1996): This group, now in peak spending years, is deeply influenced by climate narratives and values purchases that reflect ethical choices. They want transparency in sourcing and craftsmanship.

- Gen Z (born after 1997): Even more radical, Gen Z expects brands to be climate leaders. A Deloitte survey (2022) found 57% of Gen Z luxury consumers actively choose brands with visible sustainability actions. They see eco-choices not as compromise, but as prestige.

Eco-Prestige as Identity

Carrying a bag made from mushroom leather isn’t just about style—it’s about broadcasting values. In luxury psychology, this is called conspicuous sustainability: the idea that sustainability itself becomes a visible marker of status. A mushroom leather Hermès bag may eventually be perceived as more elite than a calfskin Birkin, because it combines rarity, innovation, and responsibility.

Transparency and Trust

Modern consumers want proof, not promises. QR codes on products linking to sourcing information, third-party certifications, and impact metrics are becoming essential. Luxury buyers are educated and skeptical—they will scrutinize “greenwashing.”

Experiences Over Ownership

A Bain report notes that younger generations value experiences and values alignment over possessions. This is why resale, rental, and sustainable luxury clubs are booming. In this context, a sustainable Hermès product isn’t just an accessory—it’s part of a lifestyle statement.

For insights into the making of Hermès icons, see our blog on Inside the Atelier: Tools of the Trade

The Challenges Ahead

Despite the progress, there are real obstacles that luxury brands must navigate.

Scaling Biotech Materials

Mushroom leather, cactus leather, and lab-grown collagen are promising—but their production volumes are tiny compared to the global leather market. Scaling them up requires enormous investment in bioreactors, labs, and supply chains. For now, most bio-leathers remain limited to capsule collections.

The Cost Barrier

Luxury consumers accept high prices, but margins still matter. Bio-materials often cost two to three times more than conventional leather to produce. Until production is streamlined, the economics remain difficult. Hermès can absorb this because of its price positioning, but mass adoption across fashion will be slower.

Tradition Versus Innovation

For brands like Hermès, leather isn’t just a material—it’s heritage. There’s a delicate balance: innovate too quickly, and you risk alienating traditional clients; move too slowly, and you lose younger buyers. Hermès’ hybrid approach—introducing mushroom leather in a familiar Victoria bag—shows its careful navigation.

Consumer Perception

Convincing elite buyers that alternatives are luxurious enough is a challenge. Vegan leathers made of plastic set a negative precedent, often viewed as inferior. Mushroom leather must prove not only sustainability but also emotional value, durability, and timeless appeal.

Regulatory Uncertainty

Global standards for eco-materials are inconsistent. What qualifies as “sustainable” in Europe may not meet U.S. criteria. Without standardized certifications, brands risk accusations of greenwashing, even when their intentions are genuine.

Hermès’ cautious rollout—anchored in storytelling, artistry, and quality assurance—positions it well to overcome these barriers, but industry-wide adoption will take time.

Toward a Circular Luxury Economy

Mushroom leather is one piece of a broader rethinking: luxury is moving from linear production (“make, sell, discard”) toward circularity.

Resale as Growth, Not Cannibalization

The luxury resale market is booming, projected to reach $68 billion by 2028 (ThredUp). Hermès benefits more than any brand: its Birkin and Kelly bags often resell for above retail price, proving that durability and desirability create intrinsic circularity. Unlike fast fashion, resale doesn’t cheapen Hermès—it enhances its mystique.

Repair as Core Service

Hermès repairs over 200,000 products annually. This isn’t just aftercare; it’s a business model. By encouraging restoration, Hermès keeps items in circulation, reduces waste, and reinforces its “buy once, treasure forever” philosophy.

Waste Reduction and Materials Innovation

Hermès is experimenting with precision-cutting technology to reduce leather offcuts, while other brands are turning offcuts into small leather goods. Mushroom leather fits into this mindset—using renewable feedstocks instead of finite resources.

Low-Carbon Manufacturing

The maison is gradually transitioning its workshops to renewable energy. Across the industry, luxury players are investing in low-carbon logistics, green chemistry for dyeing, and regenerative agriculture.

Closed-Loop Models

Future innovations may allow old bags or textiles to be broken down at the fiber level and re-engineered into new products. LVMH and Kering are already testing textile recycling startups.

For Hermès, mushroom leather is a first step toward this model: proving that luxury can be regenerative, not extractive.

Conclusion: Mushrooms, Magic, and the Future of Luxury

Hermès’ mushroom leather experiment represents more than material innovation. It is a philosophical pivot: proof that sustainability can sit at the heart of exclusivity.

Tradition is not being abandoned—it’s being reimagined. As luxury evolves, a Birkin made with mushroom leather may one day carry more prestige than one in calfskin, because it signals both timelessness and responsibility.

By 2030, Bain & Company predicts that 50% of luxury revenue will come from brands with strong ESG credentials. Hermès, through Sylvania, is already positioning itself there.

The future of luxury isn’t about choosing between heritage and sustainability. It’s about weaving them together—like mycelium beneath the forest floor, creating strength in unseen networks.

Hermès is showing us that in the next era of eco-luxury fashion, mushrooms may very well be the new gold.

Recent Posts